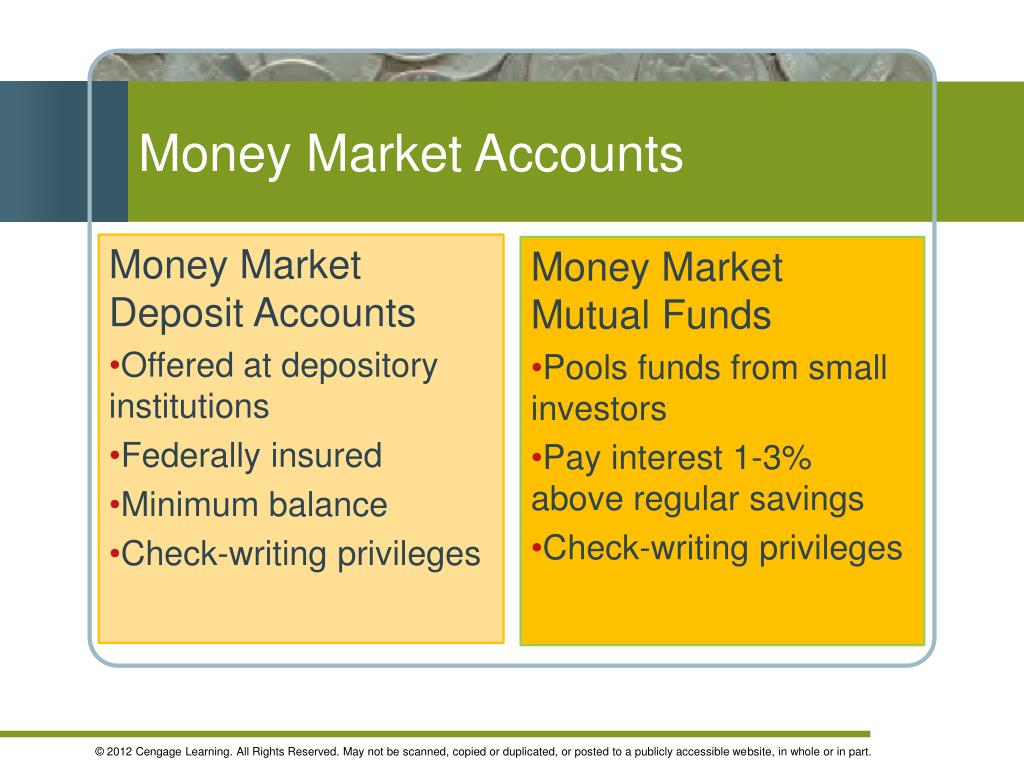

Money Market Deposit Account

Higher Yields + Unlimited Withdrawals

Take your deposits to the next level with a GFCU Money Market Deposit Account. Move up to an account that has the potential for higher returns over a traditional savings account. Benefit from higher rates and check writing privileges while saving for your next financial goal. This account is ideal for savers who maintain higher deposit balances.

Open an account for a minimum of $2,000 and benefit from unlimited in-person withdrawals and transfers.

A money market account is a type of savings deposit account that can be found at banks and credit unions. These high-rate money market accounts may pay a higher interest rate than traditional. Money Market Deposit Accounts are insured and allow you earn higher dividends as your balance increases. Open with a $2,000 minimum deposit Get a dividend rate as high as 0.35% APY. UNLIMITED in-person withdrawals and transfers.

Money Market Deposit Accounts are insured and allow you earn higher dividends as your balance increases.

- Open with a $2,000 minimum deposit

- Get a dividend rate as high as 0.35% APY*

- UNLIMITED in-person withdrawals and transfers

- Funds federally insured up to $250,000

Money Market Deposit Account Definition Economics

Money Market Rates

| Daily Balance | Dividend Rate | Annual Yield (APY) |

|---|---|---|

| $2,000-$25,000 | 0.25% | 0.25% |

| $25,000.01-$50,000 | 0.30% | 0.30% |

| $50,000.01+ | 0.35% | 0.35% |

All rates are Annual Percentage Yields (APY). The APY is as of 02/25/2021.

There are many ways to become a member, and you can establish your membership with just $5. There are also many benefits to becoming a member of a credit union, including access to dividend-yielding savings and deposit accounts, as well as competitive loans and credit products.